- +91 9511117684

- shweta@dataman.in

What is the Construction Linked Payment Plan (CLP)?

Table of Contents

Post Views: 22,025

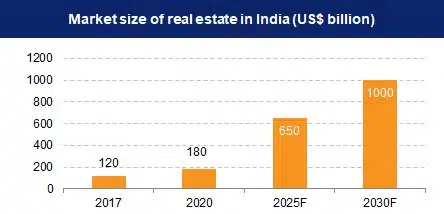

India’s real estate sector has shown exceptional growth in the past decade and the major developments are yet to come. A report by India Brand Equity Foundation (IBEF) shows India’s real estate sector is expected to touch a US$1 trillion market size by 2030. It is expected to contribute 18–20% of India’s GDP at that time.

Effective policies and schemes, particularly the construction-linked payment plan, have fueled this exceptional growth.

Buying a property is a once-a-lifetime decision for many of us and it involves a big chunk of money upfront. To ease the burden, the construction linked payment plan offers a financing option for property purchases. The plan allows users to make payments in stages as construction of the property progresses.

What is Construction Linked Plan (CLP)

Construction linked plan is applicable only to under-construction properties. When a property-buyer purchases an under-construction property, he doesn’t have to pay the entire amount of flat cost to the developer upfront.

Usually, three parties are involved in the construction linked plan: the buyer, the builder and the financier. Here the financiers are banks and they disburse the money to the builders on behalf of the buyer.

The funds are released by the bank as per the actual construction progress of the project. The construction work is divided into multiple stages and a pre-decided amount is allocated for each stage. As the builder completes that stage, the bank releases the amount associated with that stage. However, in this construction linked plan, the first 2 or 3 instalments are time-based (within 6 months).

Pre-EMIs of the buyer are calculated based on the amount disbursed to the builder. We will understand this with an example given below.

Let’s assume the property value is 1 Crore. The buyer paid 10% of the amount as a down payment and the rest of the 90% amount is a home loan.

| Payment Particulars |

Amount (in %) |

Amount (In Rupee) |

Total Amount Paid |

|

Earnest Money |

3% |

3 Lac |

3 Lac |

| Booking amount (down payment) paid with 45 days from booking |

10% |

10 Lac |

13 Lac |

|

On Agreement or 90 days from date of booking |

20% |

20 Lac |

33 Lac |

| After completion of foundation/plinth |

10% |

10 Lac |

43 Lac |

|

After completion of 1st floor |

10% |

10 Lac |

53 Lac |

|

After completion of 5th floor |

10% |

10 Lac |

63 Lac |

|

After completion of 10th floor (final floor) |

10% |

10 Lac |

73 Lac |

|

After completion of flooring, furniture, lift, staircase, plaster |

10% |

10 Lac |

83 Lac |

| On possession | 17% |

17 Lac |

1 Crore |

Here's how it works:

- The property buyer pays earnest money and booking amounts that could range from 5% to 20%. (10% in the given example above).

- Rest of the money is financed by the bank as a home loan.

- Bank releases money to the builder as per the progress of the property.

- The buyer will pay pre-EMIs only for the amount released to the builder.

- Before possession, the bank pays the whole amount to the builder.

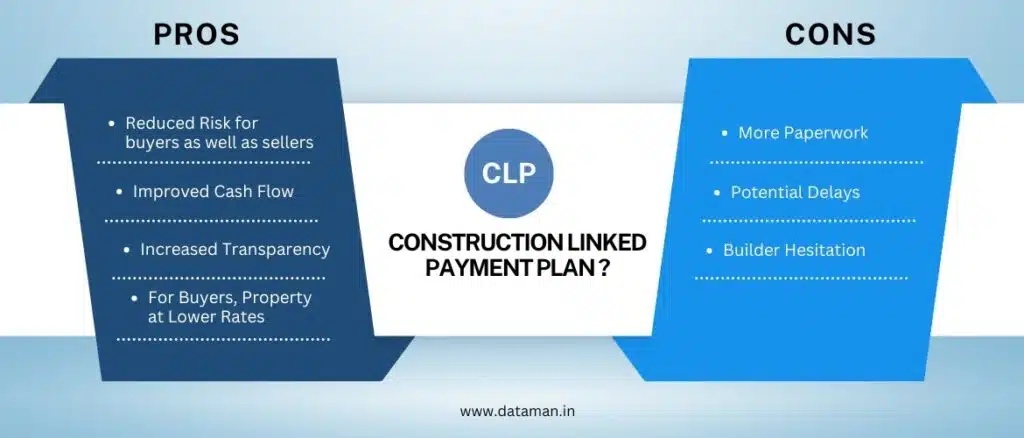

Construction Linked Payment Plan (CLP) Pros and Cons

Every plan or policy has two sides, and CLP is no different. Let’s understand the good side and the not-so-good side.

Pros:

Reduced Risk for buyers as well as sellers

The construction linked payment plan protects the buyers because they only pay as the construction progresses. Banks pay on behalf of the buyers. When a bank is involved in the process, they thoroughly check all the documents, permissions, NOCs and others. If the project gets delayed or halted, there’s less risk of losing money.

On the other hand, builders get a steady flow of cash to keep the project moving.

Improved Cash Flow

The plan allows the builders to spread the cost of the whole project over a fixed-time. This helps them manage their own finances better and reduce the risk of financial crisis. Plus, a good track record of completing milestones on time helps builders build trust with banks for future projects.

Increased Transparency

Being a bank involved in the plan, there are clear milestones, both buyer and builder know exactly what to expect.

For Buyers, Property at Lower Rates

Builders start booking as they announce their new projects. At the initial stage, the rates of the property used to be low. The buyers can get benefit by booking the property at that time.

Cons:

More Paperwork

There will be agreements, milestone details, loan paperworks and other documents involved in the plan. This is where the role of a robust software comes in. An easy-to-use software solution eliminates the paperwork and optimizes the workflow.

Potential Delays

Delay in project means you’ll have to bear the rent of your current residence and pre-EMIs for a longer period. Additionally, any planned events may be disrupted or postponed.

Builders may withdraw up to 80-90% of the project funds according to the payment schedule, then delay completion citing various reasons.

Builder Hesitation

While builders often prefer a larger upfront payment, a CLP’s security and transparency could make them more willing to alternative payment structures.

Conclusion

It is imperative to consider your needs and different options available in the market before buying. Usually under construction properties are less expensive but buyer’s must wait a long time before possession.

Construction linked payment plan (CLP) benefits buyers, builders, and financiers—everyone involved in the plan. The plan ensures strong fund management. However, keeping track of the various stages and payments can be a real hassle.

This is where Real Builder steps in. Our construction management software helps you easily track progress, submit invoices, and get paid faster – all in one place.

Need more information? Contact us today.

Frequently Asked Questions

Q. What is the full form of CLP plan?

Ans. The full form of CLP plan is Construction Linked Payment Plan.

Q. Is a construction linked payment plan good?

Ans. a construction linked payment plan is beneficial for all parties involved i.e. buyer, developer and financier. It reduces the risk of buyers as financiers disburse the funds to developers on behalf of the buyers and the payment is done as per the progress. Complete payment is done only after the possession.

Q. What is the payment structure for under construction property?

Ans. The payment structure can vary from builder to builder. Most builders offer flexible payment options. Buyers typically make a down payment of 10% to 20% to secure the property. The remaining amount can be financed flexibly.

0